The Impact of Data Compliance on Business and Profitability

Synopsis:

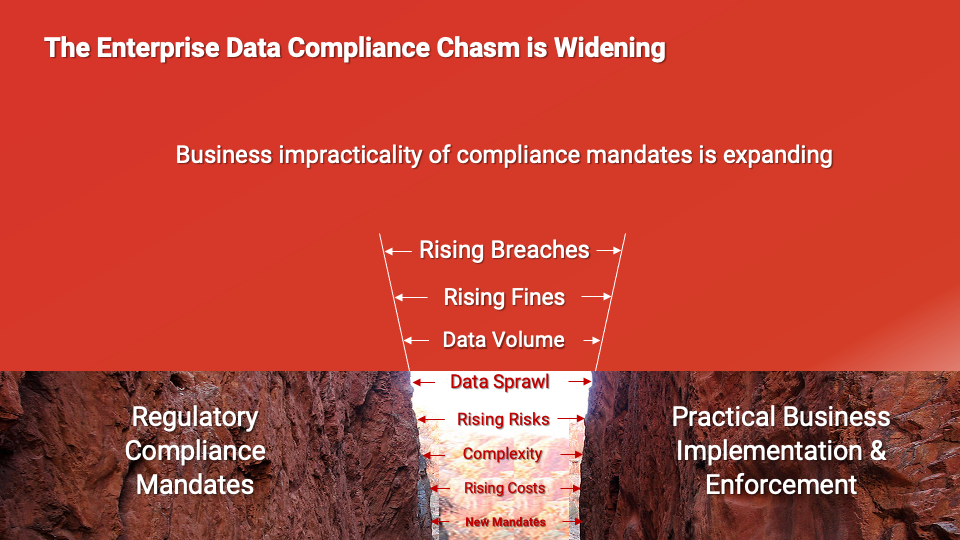

The gap between regulatory compliance mandates and practical implementation and enforcement is widening. Many would characterize the gap as a “Compliance Chasm”. As digital technology penetrates every aspect of modern life, enterprise data volume and data sprawl are growing exponentially. To protect consumers, compliance and governance bodies are increasing data regulations without consideration for the economic and operational impact on business enterprises.

Despite rising investments in privacy, security and compliance, today’s whack-a-mole enterprise strategy of reacting to new compliance mandates is not keeping up. To “Cross the Compliance Chasm” and take back control to stop expanding enterprise risks, new thinking is required to reduce the cost, complexity and impact of implementing current mandates, while future proofing the enterprise for new regulatory environments.

Enterprises Are Facing Multiple Expanding Enterprise Risks

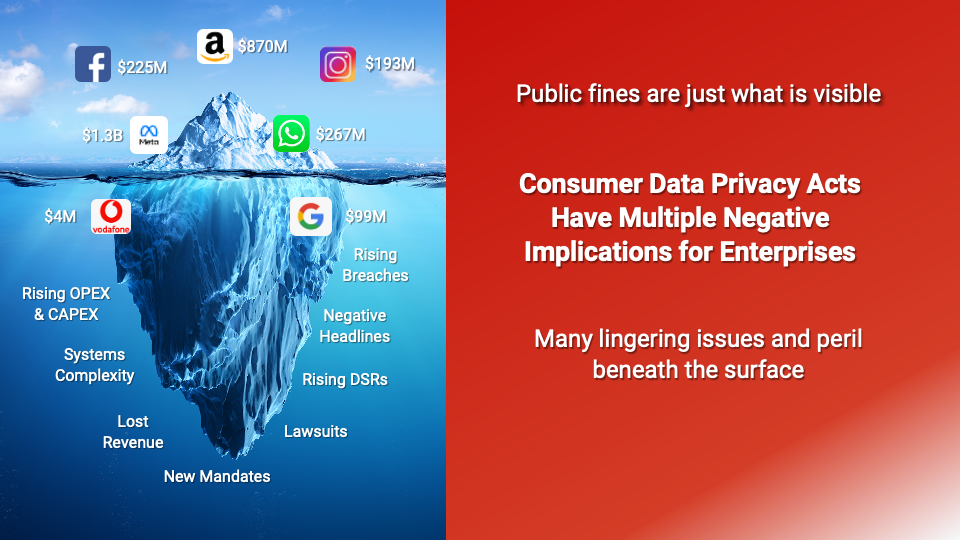

Large Compliance Fines

The frequency and size of regulatory fines are rising for enterprises that do not properly protect consumers’ data. In January 2023, Meta was fined $225M and $193M for Facebook and Instagram for GDPR violations respectively by the Irish Data Protection Commission. Other GDPR violations include $99 million (€90M) in fines to Google by France’s CNIL and $877 million (then €746 million) to Amazon in 2021 by Luxembourg officials. By May 2023, Ireland’s Data Protection Commission concluded an enquiry into Meta Ireland and fined the social media giant an additional $1.3 billion (€1.2B) for additional violations.

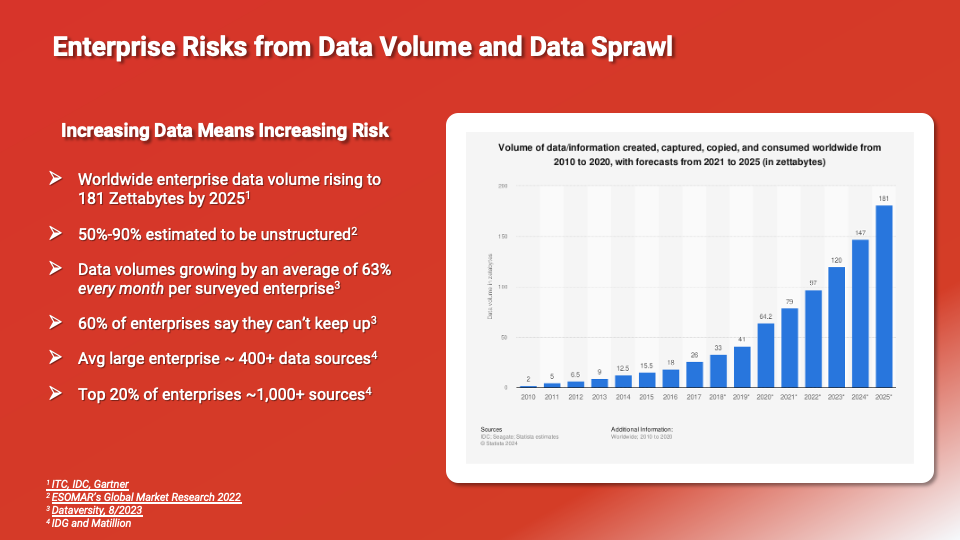

Exponentially Rising Enterprise Data

By 2025 the volume of data/information created, captured, copied, and consumed worldwide is forecasted to reach 181 Zettabytes.[1] (That is 181 followed by 21 zeros.) Nearly 80% of companies estimate that 50%-90% of their data is unstructured.[2] Think text, video, audio, web server logs, or social media activities. Data professionals see data volumes growing by an average of 63% every month in their companies – and nearly six in 10 organizations say they can’t keep up.[3]As enterprise data expands, data breaches are increasing with a corresponding rise in compliance fines. More data means more data risk and therefore business risk.

[1] IDC; Seagate, Statista 2024

[2] ITC, IDC, Gartner and ESOMAR’s Global Market Research 2022

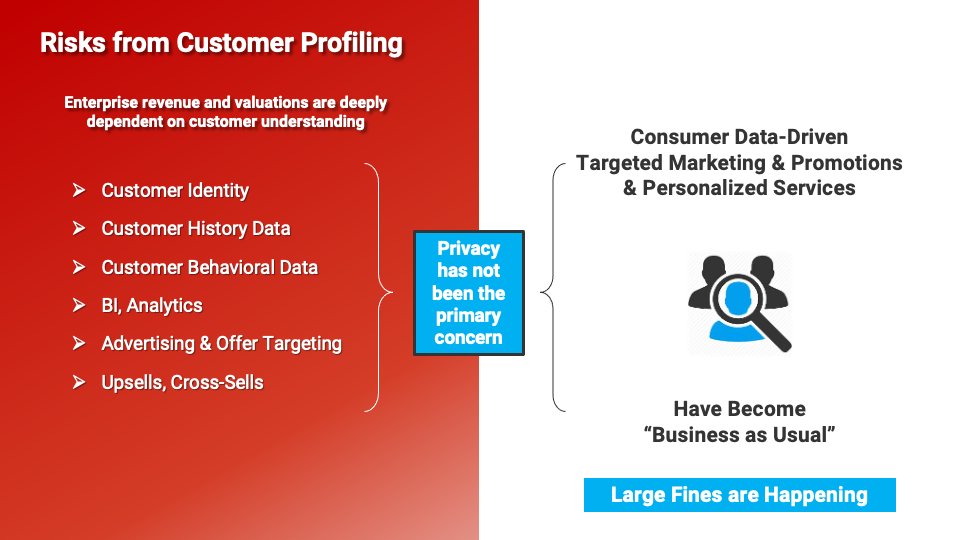

Growth in Consumer Profiling

Over the past decades, billions of dollars have been invested in business intelligence and analytics to turn customer engagement and transactional data into behavioral profiles. Enterprises have also been actively buying and selling customers’ individual data to enhance the breadth and depth of these profiles. Better data results in better customer understanding, when used in real-time, increases engagement and monetization.

Over the last few decades, these customer data-driven practices have become synonymous with “business as usual”. Compliant or not, the truth remains that customer data and its use is of high value to businesses. Profitability has become highly dependent on deep customer understanding, powered by petabytes of sensitive and anonymous consumer data in use before, during and after purchase. “Business as usual” is expanding the Compliance Chasm and associated business risks, with almost no end in sight.

Hidden Perils

Beyond the risks from rising data volumes, data sprawl, and “business as usual”, enterprises also face rising risk from unintended effects of third parties. Large corporate data incidents make for primetime news headlines and revenue. As news spreads about data breaches, consumer fear spikes. Fearful consumers then submit DSRs (enterprise data service requests) to remove their personal data and reduce their exposure. The increased DSR volume is expensive to process in today’s highly manual data compliance and enterprise IT workflows.

Another source of hidden enterprise risk comes from profit-driven attorneys with technical skills and international reach, who can detect compliance violations in cross-border enterprises. Large class action lawsuits with big attorney fees are becoming commonplace and the payoff in settlement fees can be substantial for attorneys who are skilled at weaponizing compliance mandates against public or private companies.

Compliance Disconnect

Today’s global, national, and regional data compliance mandates were created with the best of intentions – to protect consumers’ privacy and keep their data secure. But this “protection” has come at a very steep cost and burden to digital enterprises Most security and privacy compliance policies have been formulated without enough consideration for the impact on business enterprises.

More importantly, these compliance policies were created long before adequate and scalable technologies emerged to enforce these policies. The technical and operating challenges for digital enterprises and organizations go much deeper than most government compliance bodies appreciate. Today’s security, privacy, and data compliance technology solutions are simply not keeping up with protecting enterprises and therefore, their customers’ data either.

See Part 2 for How Businesses are Responding to the Compliance Chasm

Contact Us

For copies of Crossing the Compliance Chasm, please email marketing@chorology.ai.

For further information please contact: info@chorology.ai

Chorology, Inc.

2001 Gateway Place, Suite 710, West Tower,

San Jose, CA. 95110 | Main: (408) 713-3303